Dear Client,

The Official Gazette of the Spanish State BOE of 28 December 2022 published Law 38/2022 of 27 December on the introduction of temporary energy taxes and taxes on credit institutions and financial credit institutions, which introduces the temporary solidarity tax on large estates and amends some tax provisions.

This law introduces two temporary levies for two very specific sectors of the economy:

- Levy on the main operators and producers of oil or gas, coal mining or oil refining. This is a non-tax public benefit payable in 2023 and 2024 at the rate of 1.2% of turnover.

- Tax on financial credit institutions and facilities. This is a non-tax public benefit; the amount payable is 4.8% of the sum of net interest income and income less fees and commissions and applies for the years 2023 and 2024.

However, the same law introduces the solidarity tax for large estates and changes other tax regulations, which we will explain in more detail below:

- TEMPORARY SOLIDARITY TAX ON GREAT WEALTH

- CORPORATE INCOME TAX

- WEALTH TAX

TEMPORARY SOLIDARITY TAX ON GREAT WEALTH

The law passed provides for this tax, which is a supplement to the wealth tax and is levied on the net assets of individuals of more than 3 million euros.

Thus, if, as in the Balearic Islands, individuals are already taxed on their net assets, they must not pay this tax.

The solidarity tax on large estates is applied throughout the national territory, so that in the Autonomous Communities where no wealth tax is paid because they have provided for a reduction of this tax, the new tax must be paid (to the State, not to the Autonomous Community) if the person’s wealth exceeds 3 million euros.

The same assets and rights that are also exempt from wealth tax (main residence up to a certain limit, shares in companies that meet certain requirements, etc.) are exempt from this new tax.

The same rules apply to the determination of the assessment basis for this tax as for the wealth tax. An exemption amount of at least € 700,000 applies.

The accrual takes place as of 31 December of each year, as is the case with wealth tax. It will be applicable in 2022 and 2023.

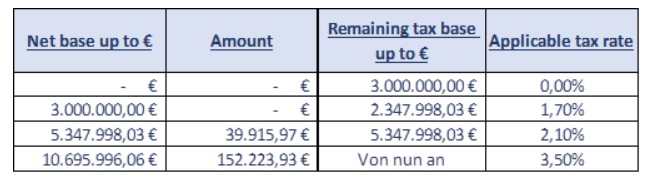

The fee is calculated according to the following table:

The same limits apply to the income tax (IRPF), the personal income tax (IP) and the wealth tax (Impuesto de solidaridad de las grandes fortunas) as to the sum of the quotas for the personal income tax (IRPF) and the personal income tax (IP).

If the sum of the three quotas exceeds 60% of the IRPF tax base, the amount of solidarity tax on large estates is reduced until the specified limit is reached, but the reduction may not exceed 80%.

In practice, residents of the Balearic Islands who already pay property tax are not affected by this tax. We will see this with two examples:

- Let us assume that a natural person has net assets (net assets after deduction of debts and tax-free goods and rights) of € 3,500,000.00. The wealth tax to be paid would amount to € 54,697.54. The amount of the solidarity surcharge for large estates would be € 8 .500.00. Since he can deduct the amount of wealth tax paid, the amount payable for the new tax would be zero.

- Let us assume that a natural person has a net wealth (net wealth after deduction of debts and tax-exempt goods and rights) of € 6,500,000.00. The tax payable would amount to € 130,945.28 for wealth tax. The amount of the solidarity surcharge for large estates would be €64,108.01. Since he can deduct the amount of wealth tax paid, the amount payable for the new tax would be zero.

WEALTH TAX FOR NON-RESIDENT

The Wealth Tax Act for individuals not resident in Spain, so that they’ll be obliged to tax in Spain when:

- Being the direct owner of a property in Spain

- Owing shares or participations in Spanish or foreign companies at least 50% of whose assets consist directly or indirectly of real estate located in Spain For the calculation of assets, the net book values of all assets recorded in the books of the entity are replaced by their market values as at 31 December.

These changes will already take effect for the 2022 wealth tax, which must be filed between May and June 2023.

At FIS3 Asesores we remain to your disposal to clarify any questions you may have regarding this matter.